PMA Research (PMA) has published its latest sell-through tracking report on large-format (32-inch and larger) flat-panel displays being sold by US distributors who serve commercial markets.

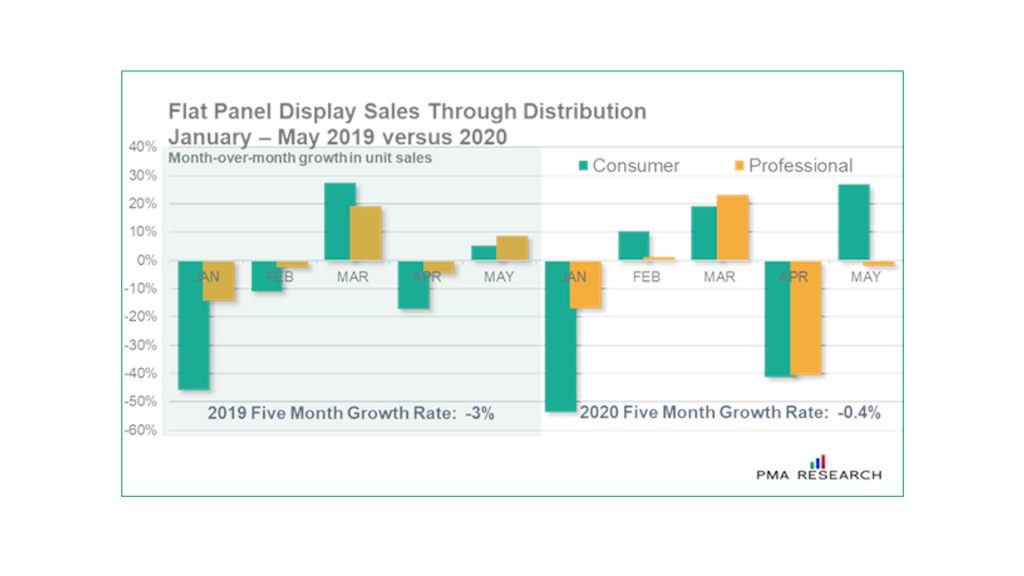

Many US distributors of flat-panel displays saw sales improve in May versus April. Loosening restrictions for some states allowed installations that were postponed from April to proceed. May unit sales and revenues increased by double-digits over April for the majority of reporting distributors. Even though May has always been a cyclically strong month compared with April, this uptick in business is encouraging news while navigating through COVID-19 shutdowns. In fact, the five-month rolling growth average for January-May 2020 fared better than the same five-month average growth in May 2019.

May sales were boosted by strong sales of consumer products. Consumer TV volumes were up nearly 30 percent, and revenues grew by nearly 40 percent over April’s slow sales. This was likely the result of some stimulus money arriving to those who were still gainfully employed, so the funds were used to upgrade the home entertainment system or add a second television. In addition, more delivery resources were available for non-essential goods in May so the backlog of online orders for consumer televisions were finally able to ship.

After the sharp declines in April, professional display sales volumes were flat in May, and revenues crept up slightly giving some signs of mild baseline improvements in the market. This is the first month we have seen any significant volume of 8K display sales. They were all QLED technology, and the 82-inch models carried a wholesale price under $7,000. Also, the average price for a 65-inch iFPD fell below $2,000 in May for the first time, though some models have been sub-$2000 all year. Additionally, 65-inch and 75-inch models accounted for nearly 50 percent of the iFPD volume in May, signaling that K-12 installations may be starting back up in advance of the coming school year.

PMA’s monthly Flat Panel Distributor Tracking report offers timely sell-through data and analysis on unit sales and market trends of large-format displays. These reports are ideal for tracking product and channel trends.

For more news from Sound & Communications, click here.