Editor’s Note: As trade- and tariff-related issues become more and more prevalent on the nightly news, Sound & Communications thought it worthwhile to offer our industry a primer on how tariffs work, how they affect the economy and how they affect the commercial AV industry. Our writer, Lynnette Reese, cast a wide net to speak to both economic experts and AV industry veterans. Enjoy this introduction to trade and tariff issues.

The United States’ executive branch’s power over trade with foreign nations rests on Trade and Tariff Acts, as well as on various agreements rooted in international organizations like the World Trade Organization (WTO). With tariffs, countries can wield power over trading partners, although the impact is far less than, for example, sanctions have. Under the authority of section 301 of the Trade Act of 1974, American tariffs against China have been in place since July 2018. Additional tariffs, originally set to take effect late this year, have been put on a temporary hold as of this writing.

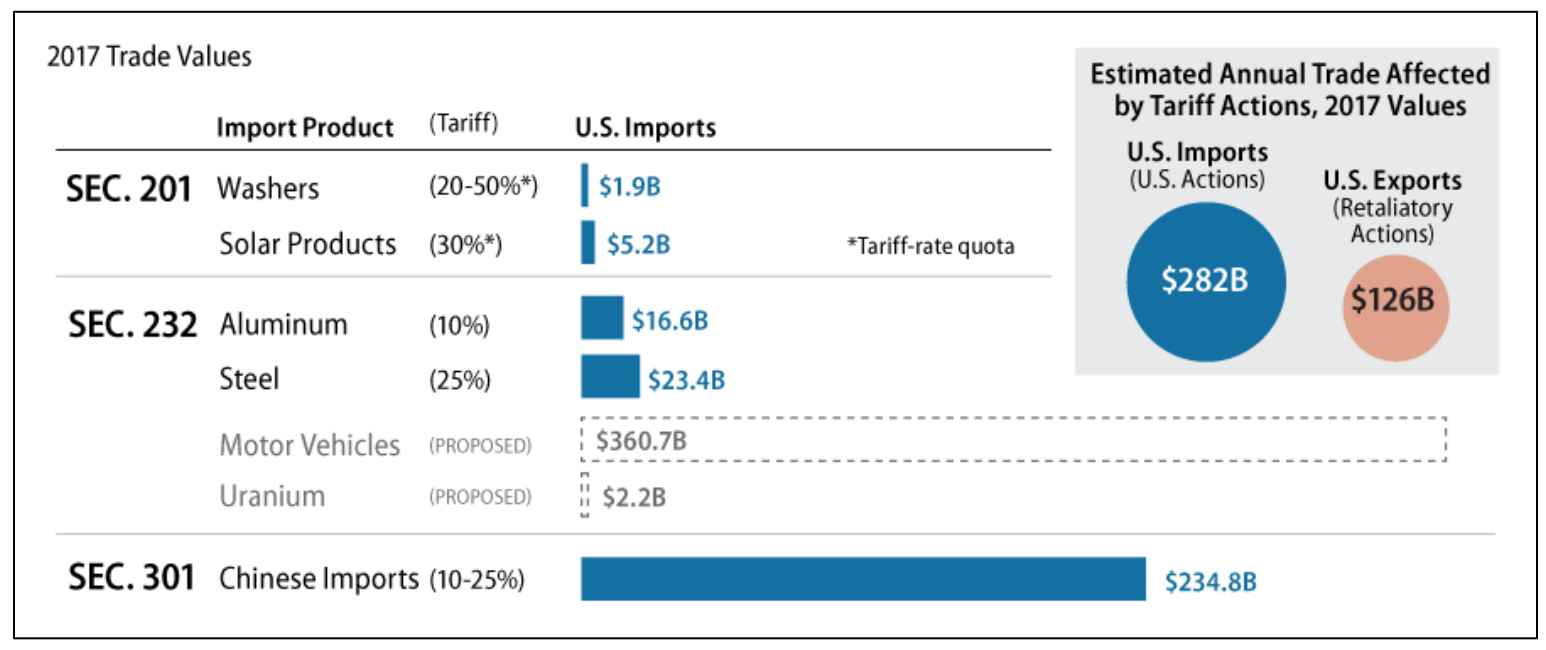

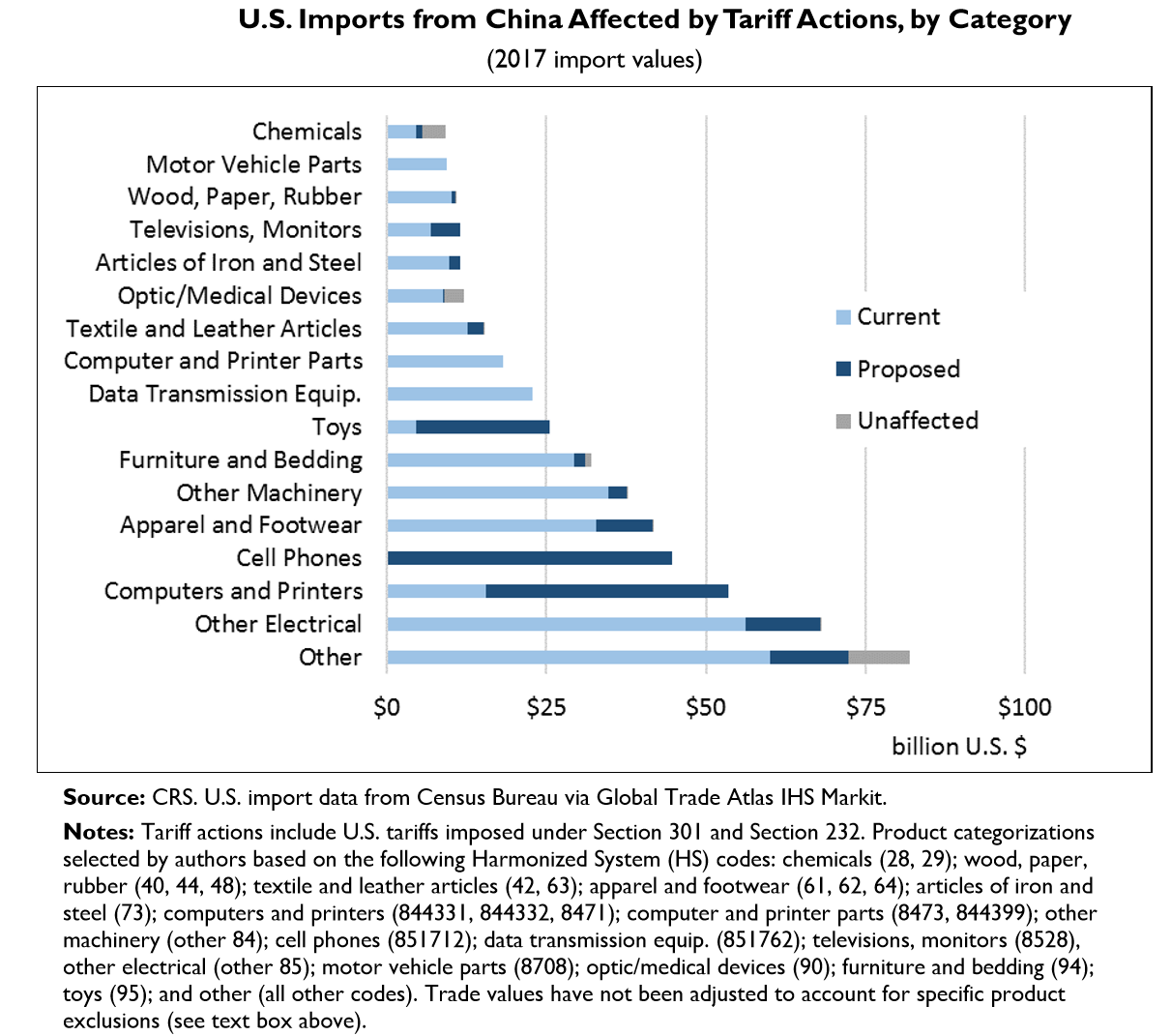

On October 9, the Congressional Research Service (CRS) stated the following in “US-China Tariff Actions by the Numbers” (PDF): “US tariffs currently affect 66.6 percent of US imports from China, which is set to grow to 96.5 percent once all proposed tariff increases take effect…. On October 15, 2019, the United States is to increase many existing tariffs from 25 percent to 30 percent. On December 15, 2019, the United States is to impose an additional 15-percent tariff on most remaining imports from China….”

Initial tariffs covered steel, aluminum and a few white goods. Since then, the US has collected duties of $33.7 billion on Chinese imports (through mid-October). The next tariff, which was originally set for mid-October, has been delayed to try to grease the skids for further negotiation between the US and China.

Who Administers And Collects US Tariffs?

US tariffs are published and administered by the US Trade Representative (USTR), who reports to the US executive branch. For three decades, the USTR has published a “Special 301 Report” (PDF) (Figure 2) every year, providing an opportunity to call out foreign countries and expose the laws, policies and practices that fail to provide effective intellectual-property (IP) protection and enforcement for US entities. The office of the USTR states in the report that the US will take appropriate actions, with the highest concern being countries that have consistently violated US IP; those countries land on a Priority Watch List.[i] China is one of 11 countries on the Priority Watch List.

The International Intellectual Property Alliance (IIPA) submitted comments on the 2019 Special Review that stated, “China maintains a number of longstanding discriminatory restrictions in the audiovisual sector that harm the US industry, limiting its ability to compete fairly and inhibiting its potential growth in this massive and fast-growing market.”[ii]

With regard to the enforcement of trade regulations and tariffs, US Customs and Border Protection (CBP) is integral. CBP operates at 328 US ports of entry, decides which products fit in the USTR’s tariff categories and collects the duties. As of early October, CBP had assessed $33.7 billion on Chinese imports since the tariffs began in July 2018.[iii]

Identifying Products Subject To Tariffs

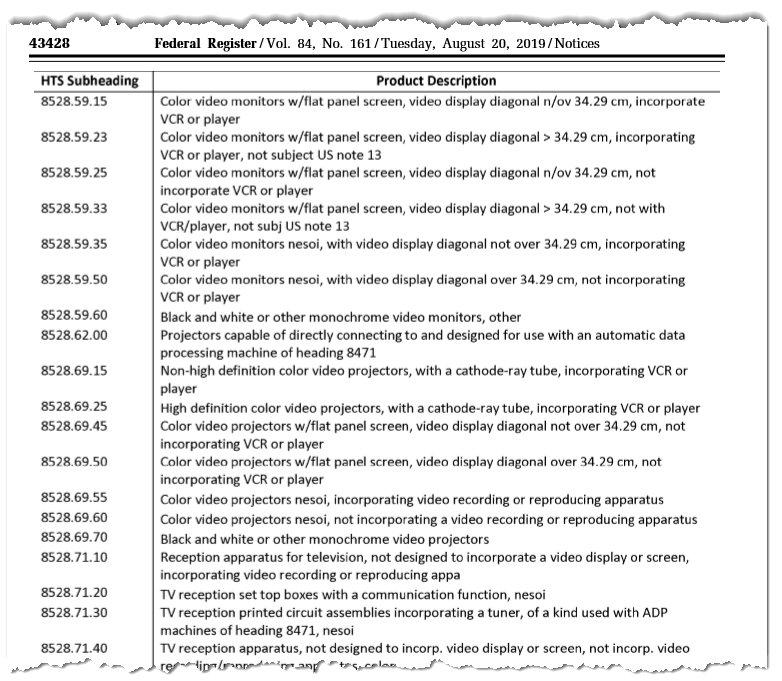

Identifying the next round of products subject to tariffs is understandably imprecise in the USTR’s “Modification to Section 301” (PDF), where annexes A and C list more than 1,000 general descriptions of products from China potentially subject to duties (Figure 4).

Uncertainty in tariff policy negatively affects businesses—including, notably, AV businesses. For instance, the time period for which quotes or bids can be honored—in deference to the customer—is uncertain until all tariffs are in place and no additional changes are expected. Many AV integrators serve customers that need long lead times of a year or more, owing to the size of construction projects and the hard budgets under which municipalities, school districts and, ironically, federal-government entities operate. Many AV integrators have already eaten small cost increases because of the initial tariffs’ effect on their outstanding proposals.

Matt Lavine, Owner of a boutique-like integrator, BugID, Inc. (pronounced “bug-eyed”), caters mostly to the commercial space for media companies, higher education, and arts and entertainment facilities. Lavine’s margins have already been affected by several small, tariff-related price increases, which he’s absorbed. Lavine said, “Tariffs don’t benefit anyone. It’s just going to increase the overall cost to the consumer. Businesses will take the brunt of the first wave of tariffs because we don’t have enough reaction time to pass that onto the consumer.”

AV-equipment manufacturers are themselves beginning to pass on the costs of the tariffs, and they’re doing so in a couple of ways. Some equipment manufacturers incorporate tariff-related price increases into their published prices. Others include them as an additional “tariff line item” on the invoice, as if it were a tax. Lavine questioned who would benefit from the funds collected as tariffs. Unlike with tax dollars, states and cities will not directly benefit from the new duties being collected.

According to a recent Pro-AV Business Index report from AVIXA, “The widely followed Institute for Supply Management manufacturing purchaser’s index clocked in at its lowest reading since June 2009. The disappointing mark knocked a couple percent off stock market indexes worldwide, and it signals two impacts on [commercial] AV. First, trade-generated manufacturing problems are driving price increases and uncertainty, which make projects difficult to price, especially since end users don’t want to pay more for hardware. Second, high prices and manufacturing problems create economy-wide problems that affect buyers of AV equipment. In an unsteady economy, end users will hesitate to invest in AV upgrades.”[iv]

Tariff-related issues are more complex than ever before, with nations having become deeply and globally enmeshed. Sean Wargo, Senior Director of Market Intelligence, AVIXA, pointed out, “We seem to be living in a highly polarized time, witnessing a heightened sense of nationalism against a backdrop of globalization and interconnectedness. Trade laws and policies are being adjusted to fit a modern world, which just compounds uncertainty.”

The Overall Financial Impact Of Tariffs

According to estimates from the Congressional Budget Office (CBO), tariff increases might diminish US gross domestic product (GDP) by 0.3 percent by 2020. The uncertainty that tariffs have caused might have already lowered the total sum of all US business investments.[v] Tariffs might hurt foreign countries in the end, if US manufacturing is able to fill the void, but, in the short term, American businesses and consumers have to endure the blitz. Another devil in the details of the tariff story is how China is responding. Although China has fewer US imports to tariff in kind, there are perhaps other ways to retaliate.

Scott Wright, President of Lifeline Audio Video Technologies, shared an interesting tidbit. He investigated a significant backlog of wireless microphones earlier this year. Wright said, “When I finally got to the bottom of it, one of the chips that go in the wireless microphones is only made in China. The same chips are used in the automobile industry. How many are going to go to the wireless manufacturer? Not nearly as much. It’s a smaller industry.” Is China retaliating by withholding shipments of components that it exclusively manufactures? Conversely, maybe it’s just a ripple in the pond of a deeply interconnected world. Wright stated, “Now, I’m sitting on 98 percent of the system ready to be installed, but I have to wait 60 days because there isn’t a component available to us.” Cash flow and customer satisfaction are the victims.

Wright’s story will ring familiar to several AV integrators. As Wright asserted, “Before the tariffs started, I would get an email from a manufacturer that stated how much and when an increase could be expected. Now, I’m getting emails announcing a nine-percent increase as of today on these items. How do I go back to a customer who got my proposal two weeks ago and say, ‘Oh, by the way, instead of $10,000 it’s $11,000’?”

Financial Impacts On The AV Industry

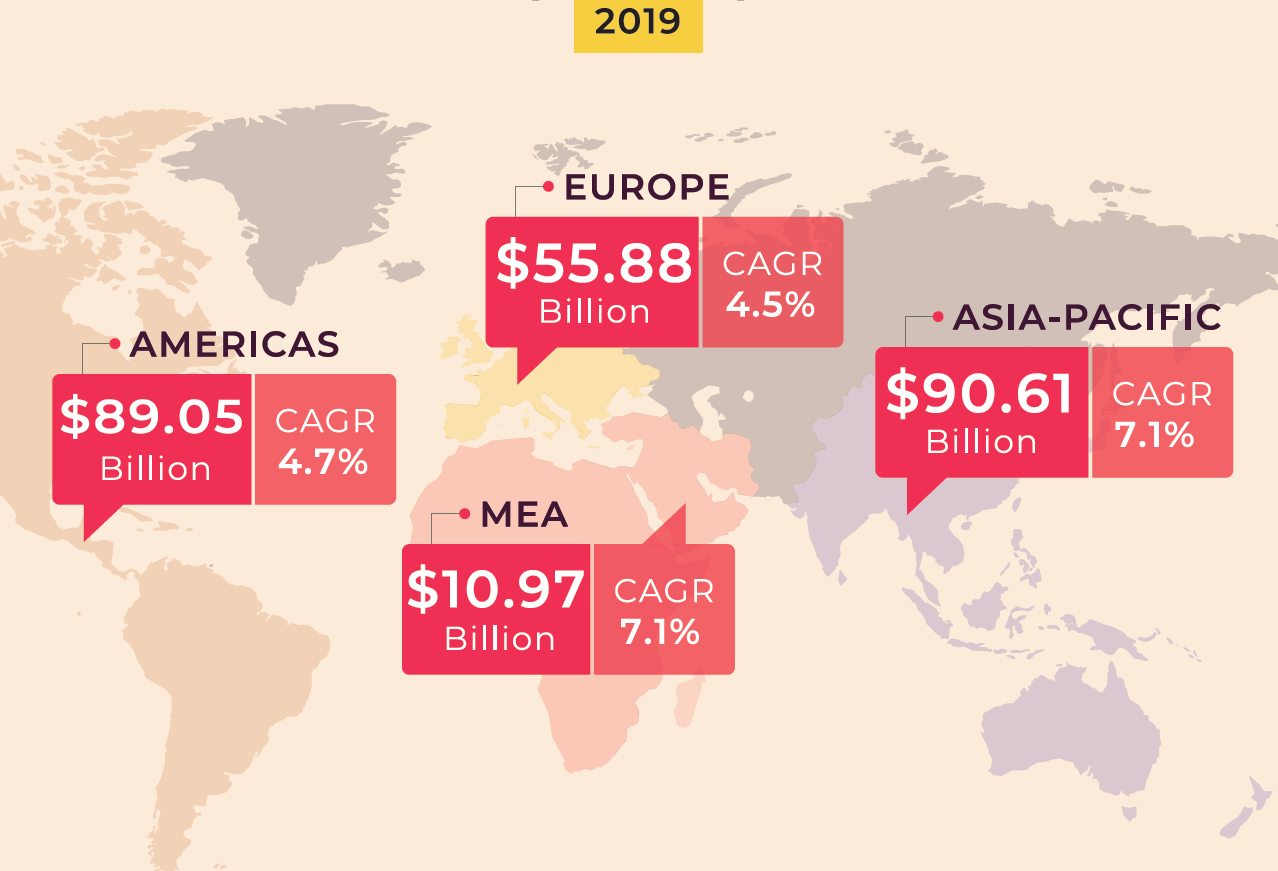

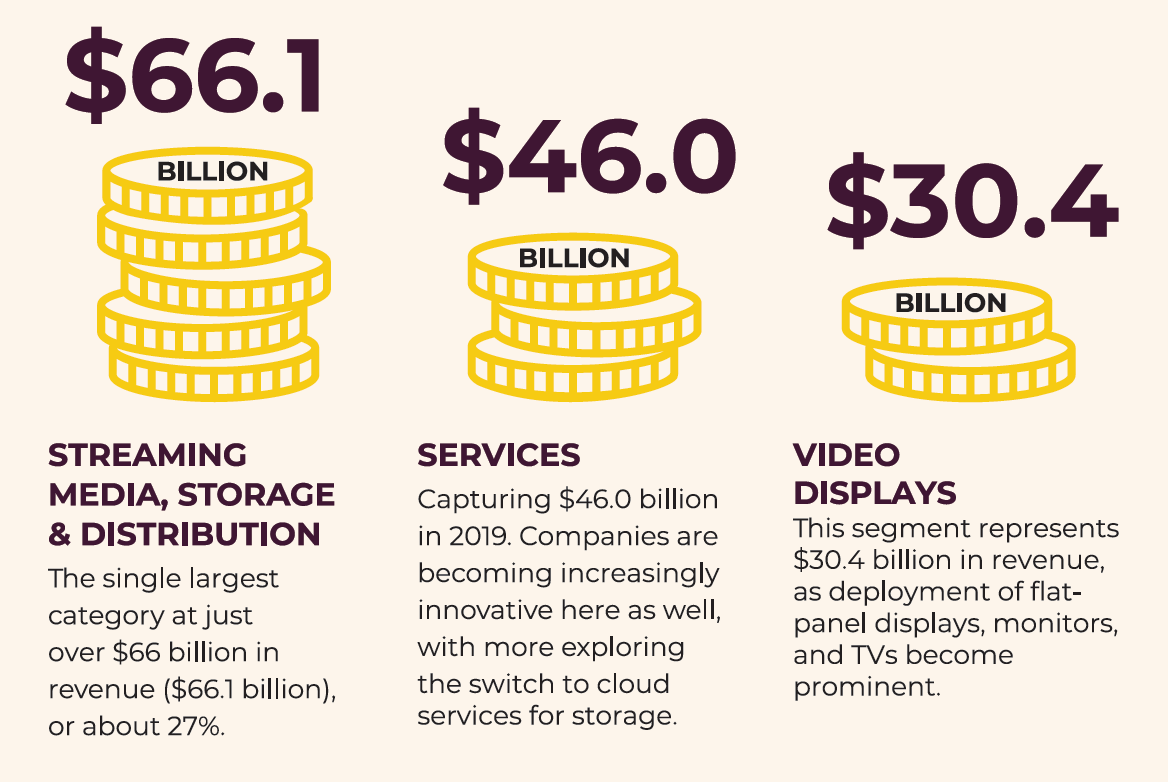

In terms of commercial AV revenues, the Asia-Pacific (APAC) market is the largest, due, in part, to China (Figure 7). All businesses face the unpredictable nature of tariffs, which are applied like a surprise tax. New duties applied at customs can take months to settle throughout supply chains. They’re on the horizon—but how and when they’re going to hit is unclear. And uncertainty is the most irritating thorn in the commercial AV integrator’s side; after all, not every business is equipped to handle tariffs, and communication between national leaders has been dicey to say the least. As Margaret Atwood declared, “War is what happens when language fails.”

Wright explained further, “The inability to plan for price increases boils down to poor communication about when tariffs are going to hit, what percentage will be applied and to which devices. Supporting proposal pricing for the long term becomes difficult. We mainly deal with schools, auditoriums, municipalities and the like. It can take much greater than 60 or 90 days to get it through a committee so they can make a decision.” Implicit in that statement is a question: Who knows what’s going to happen 60 or 90 days from now?

The upshot of all this is a high risk of suffering from diminished profit margins. Buyer beware: Choosing a lower published price might be deceiving if the tariff is listed in the invoice as a discrete line item, right above the sales tax. (Yes, tariffs will be taxed.) Hidden charges like these lead to inaccurate project estimates or less profitable projects (or both). (For a point of reference, think about when fuel surcharges were similarly added to shipping bills.)

Steve Minozzi, Co-Owner of Monte Bros. Sound Systems, Inc., focuses on house of worship (HoW) projects. As Minozzi asserted, “Much of the time, the projects do not come to fruition for nine months to a year. We have close to a million dollars of projects that are going to happen within the next year. Do you buy all this equipment now and then sit on it? That’s a lot of inventory to invest in.” Monte Bros usually honors its proposals for a year. So far, the integrator has been absorbing the costs. It has no plans to change equipment manufacturers due to its excellent, longstanding relationships, but it plans to evaluate the situation at the end of this year. If further tariffs take effect (and existing ones remain), the integrator plans to set a date for implementing change and optimistically intends to honor all existing proposals.

Dealing With The Impact Of Tariffs

For a recent Pro-AV Business Index, AVIXA polled its Insights Community about how the trade conflict affects them and how they think conditions will change over the next six months. Respondents reported that the biggest impact is that trade uncertainty is causing companies to avoid AV investment, followed by AV products becoming more expensive thanks to tariffs and supply-chain disruptions. And, unfortunately, the community sees worsening conditions, with 48 percent predicting trade-war intensification against just 15 percent foreseeing improvement, according to the report.

A mixture of tactics can be used to deal with the impact of tariffs. AV manufacturers can delay pay raises, absorb costs, move manufacturing operations or pass along the costs by raising prices, which then are passed onto the end user. Looking at an example outside of our industry, the price of washing machines in the US has grown by as much as 12 percent since the 2018 round of tariffs. According to the CRS, “If all scheduled tariff increases take effect, by the end of 2019, nearly all US imports from China will be subject to new or increased tariffs, most in the range of 15 percent to 30 percent.”[vi]

Here are a few strategies for integrators to ponder:

- Absorb smaller cost increases while implementing a shorter expiration period for new proposals.

- Be transparent with customers. Communicate potential price increases, rather than adding tariffs unexpectedly as an invoice line item. Most customers should already be aware of possible tariffs through media coverage. Check www.ustr.gov for updates.

- Diversify your business.

- Try new markets, rather than sticking to one type of venue. (Perhaps some will have shorter lead times and quicker turnaround.)

- Lean in on the service side. Yes, selling replacements will involve dealing with tariffs, but service is centered on labor, not hardware.

- Try to avoid equipment likely to experience trade-issue-related problems, choosing instead to source from other nations.

- Build up inventory before tariffs are increased. (Next tariff rounds are poised to hit items on the “Modifications to Section 301,” Figure 4).

- Take advantage of recently lowered interest rates to borrow capital, as needed.

- Be willing to walk away from opportunities that carry increased risk. (For example, projects that are much heavier on equipment, as opposed to skilled labor and service, and that have long and unpredictable timelines.)

Hard Truths

AVIXA’s Wargo mentioned a hard truth that, sometimes, can be difficult for an integrator—or anyone—to accept. “One of the options, at the end of the day, is that, sometimes, you have to walk away from a bad deal that doesn’t give you room to add value and margin to the story.”

Peter Hansen, Economic Analyst of AVIXA, stated, “You can be prepared for the worst. You don’t want your business in a terrible situation, trying to meet a price that you promised a year ago, potentially having to disappoint clients when you can no longer meet that price. Be conservative about pricing and forge a communication process with clients about the economic situation that we are in. Even if you’re an optimist about trade, no one can know for certain what’s going to happen. Making sure that you have an excellent service side of the business is going to provide a lot of value to make up for potential margin troubles on the hardware side.”

Douglas MacArthur once said, “The soldier above all others prays for peace—for it is the soldier who must suffer and bear the deepest wounds and scars of war.” Let’s hope hostilities cease before the AV industry risks any additional collateral damage.

For more information, search on “tariff” at crsreports.congress.gov or visit www.avixa.org.

[i] https://ustr.gov/sites/default/files/2019_Special_301_Report.pdf

[iii] https://www.cbp.gov/newsroom/stats/trade

[iv] https://www.avixa.org/insight/marketintel/pro-av-business-index

[v] Daniel Fried, “The Effects of Tariffs and Trade Barriers in CBO’s Projections,” Congressional Budget Offics, August 22, 2019, https://www.cbo.gov/publication/55576

[vi] https://crsreports.congress.gov/product/pdf/R/R45949

Key Resources

Official resources for keeping current on US trade and tariffs:

- FederalRegister.gov: Access the online presence of the Office of the US Trade Representative for up-to-date information on tariffs at www.federalregister.gov/agencies/trade-representative-office-of-united-states.

- USTR.gov: The Office of the US Trade Representative has press releases, speeches, reports and fact sheets on its official website, including Section 301 Investigations: www.ustr.gov/issue-areas/enforcement/section-301-investigations.

- Regulations.gov: Comment on issues at www.regulations.gov or view the 2019 Special Review hearings by searching on docket number USTR-2018-0037.